Authors: Moonsup Shin, Shu Li, Xin Cheng

At a Glance

> The coronavirus outbreak throughout Asia has disrupted tech companies' factories, delivery operations and new product launches.

> In China, COVID-19 has reshaped tech users' behavior, and it could accelerate business and government investments in digital initiatives.

> Tech companies can strengthen their business resilience through six actions to improve their crisis management, sales channels, supply chains, digital capabilities and global strategy.

The coronavirus outbreak throughout Asia has disrupted operations and upended 2020 plans for many technology companies, given the industry's heavy concentration of manufacturing bases and customers in China and nearby countries.

With the situation on the ground changing daily and the recent roller-coaster ride of financial markets, tech executives might find it difficult to focus on anything other than making sure their employees are safe and responding to the latest challenge. But tech companies can take proactive steps to build more resilience into their businesses to weather the outbreak's short-term shocks and emerge in a stronger position for the future.

We see six strategic actions tech companies in the region—and around the world—can take to fortify themselves against future crises. Before we detail them, let's unpack our latest assessment of the virus's impact on several industry segments, focusing on China and its neighbors.

| Consumer electronics

The outbreak will significantly affect demand for mobile phones and personal computers in China in the short term, but long-term essential purchases (such as phone replacement) will gradually rebound as the pandemic fades. Consumer electronics companies are facing greater pressure from logistics constraints and belated resumption of work at suppliers. These factors could delay product deliveries and throw off the new-product launch rhythm, as well as supply plans for domestic and overseas customers.

Meanwhile, the outbreak is likely to spur rapid adoption of health products, including wearable technology such as fitness trackers and smart watches.

| Communications and business equipment

Long-term demand for 5G and other communications equipment remains unchanged, but in the coming weeks, equipment sales and delivery lead time will be impacted as carrier network construction slows down in severely affected areas. Many network equipment component manufacturers in the city of Wuhan—the epicenter of the outbreak—and leading communications equipment companies in Shenzhen will face traffic restrictions and work resumption delays, putting pressure on short-term supply.

Business equipment providers will also have difficulty meeting delivery timelines. They're under increased pressure to meet spiking demand due to surging data traffic and the urgent need for remote working equipment during the outbreak.

| Software

Extensive digital technologies, applications and data accumulated in China's advanced consumer Internet ecosystem have played an important role in responding to the outbreak, and a variety of applied innovations have emerged.

For example, online healthcare delivery has exploded. Trapped indoors, many patients have turned to Internet-based options for diagnosis and treatment.

To aid in their recovery efforts, Shenzhen, Chongqing and other cities work with a smart city platform, leveraging big data to accurately track transportation and migrant workers getting back to their jobs.

Looking ahead, we expect the pace of digital transformation and investment in technology to increase in China after the outbreak. The containment efforts helped local governments recognize the value of big data platforms, accelerate cooperation with businesses and launch smart city applications. For businesses, network infrastructure enabling remote work will be an even more important part of corporate emergency plans. Digitalization, including online stores, targeted engagement and online customer service, will catalyze innovation and business model expansion.

Among consumers, travel restrictions have increased user stickiness to mobile phones and hastened the development and penetration of relevant digital services, particularly medical, education and public safety apps. New user behaviors and use cases will be cemented after the outbreak is contained and will accelerate Chinese consumers' technology adoption.

| Semiconductors

The labor shortage in large-scale semiconductor manufacturing and production lines will continue for a while, creating challenges for the overall supply chain.

Although factory automation is helping to minimize the impact, work-resumption delays will still hamper the short-term supply of memory chips, which have significant production facilities in areas affected by the virus, such as Wuhan, as well as South Korea and Japan. As for panels, Wuhan and Guangdong—a Chinese province also hit hard by the virus—are home to several leading producers' manufacturing sites. A few production lines are ramping up for new technologies, including small, flexible displays for mobile phones and large, ultra-high-resolution screens for TVs. Although panel production lines are more automated, the postponed work resumption and quarantine of individuals suspected of contracting the virus, combined with the shortage of raw materials, will slow the recovery of production capacity.

On the demand side, since the customers are all businesses, the overall demand is subject to long-term contracts and is relatively stable. But the outbreak will challenge logistics for the foreseeable future.

Let's take a closer look at the impact of the coronavirus on the mobile phone sector, since the devices play an essential role in so many people's lives. To try to predict how things might play out, it could prove instructive to look back at another disruptive health crisis: the SARS outbreak of 2002–2003.

At the time, China's mobile phone market was upgrading to 3G networks, and smartphones gained popularity. SARS sent the market into decline, but it didn't last. The market began rebounding three months after the outbreak had passed, and it stabilized as pent-up demand was released (see Figure 1). In December 2003, mobile phone production had increased about 75% from the beginning of 2003.

At this crucial stage in the global response to the COVID-19 outbreak, it's hard to say whether this virus will affect the mobile phone market as much as SARS did. But assuming there are similar outcomes, here's a more detailed outlook for mobile phone supply, demand and channels.

| Supply

COVID-19 isn't expected to substantially reduce supplies of mobile phone components, but product deliveries could be delayed

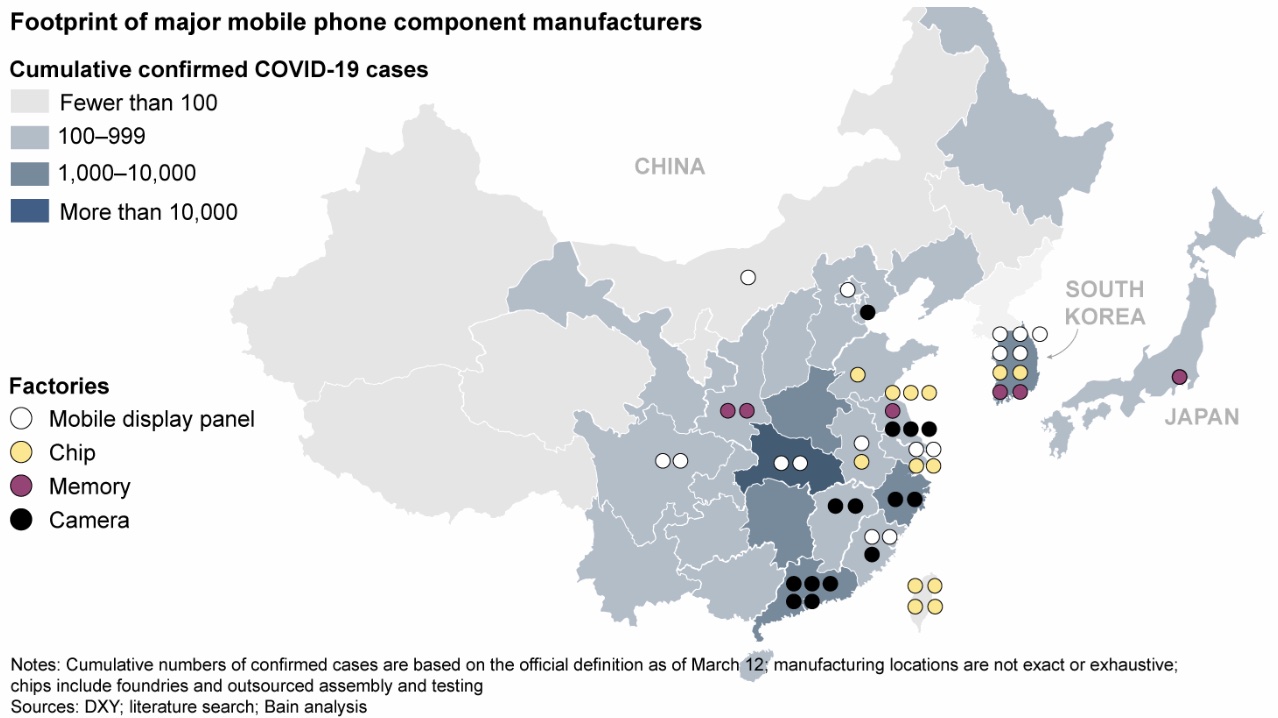

Specifically, for mobile display-panel manufacturers, a raw material shortage has created challenges, but production lines continue running without a strong threat of supply cuts.

Chip design and manufacturing are less affected by the outbreak. Their research and development staff can work from home, and safety measures have enabled production lines to keep running. Chip-assembly and test companies have recovered to more than 50% capacity, but they face pressure to meet pent-up demand in the second half of the year.

Memory component factories are less affected, thanks to highly automated production lines and an adequate stock of raw materials. As the virus spreads in South Korea and Japan, it may hamper product deliveries and other logistics in the short term.

Most major camera manufacturers' employees have returned to work, and the adequate supply of cameras in stock means mobile phone production won't suffer in the first quarter. But supplier disruptions could delay phone deliveries in the second quarter.

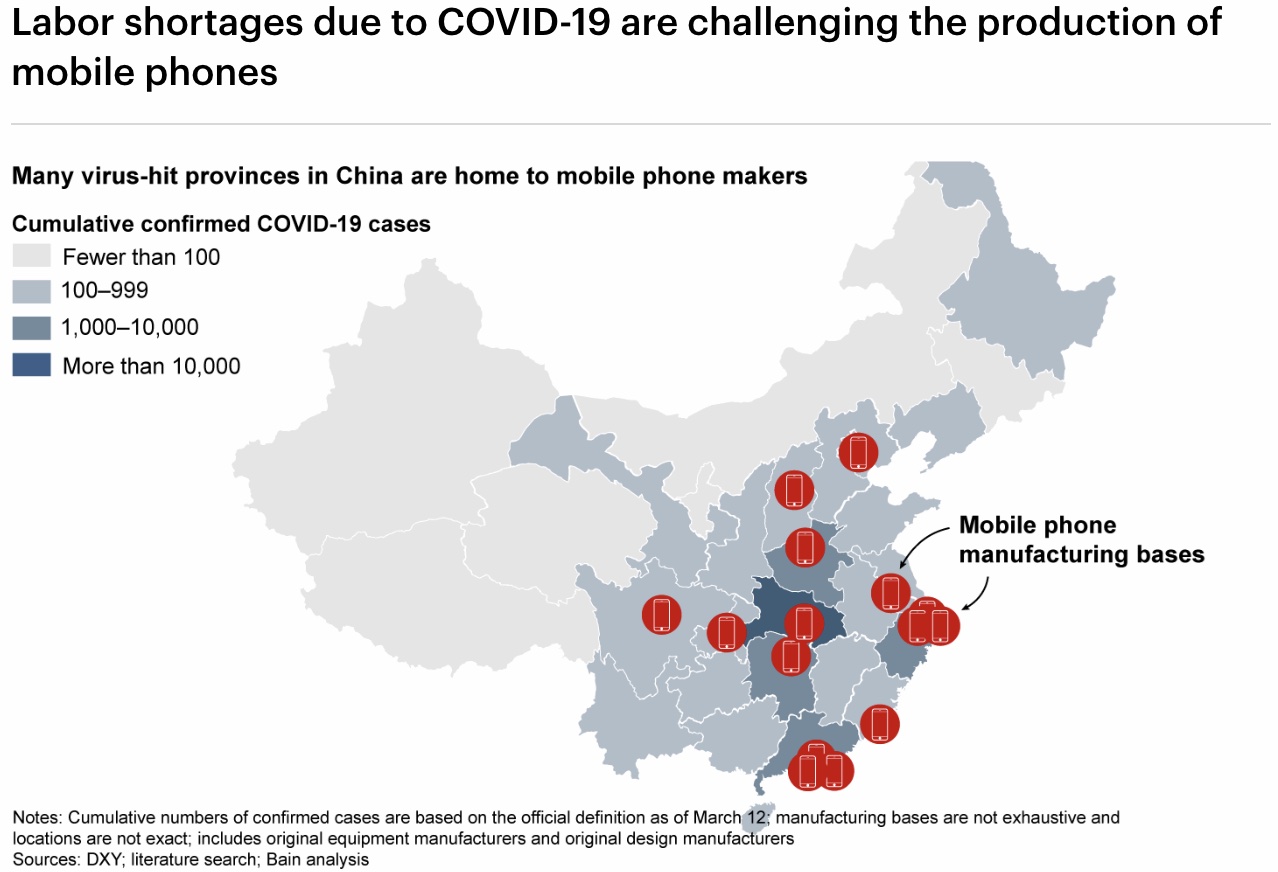

Labor shortages due to COVID-19 are challenging the production of mobile phones

The cancellation of February's Mobile World Congress 2020 in Barcelona because of coronavirus concerns meant major brands (especially Android phones) had to postpone new product releases or launch products online. Mobile phone makers have tight annual timelines for releasing new products, and any changes to such timelines can create chaos, so the coronavirus disruption will require adjustments to longer-term product plans.

The coronavirus will cause global phone makers to reassess their dependence on manufacturers in China, and many brands will likely invest in production sites in Vietnam and other Southeast Asian countries. Chinese phone manufacturers will likely also accelerate construction of overseas plants.

| Demand

Offline channels dominate mobile phone sales in China, making up 70% of sales last year. But the outbreak means fewer consumers are venturing out to brick-and-mortar stores to buy mobile phones. At the same time, the virus's impact on small and medium enterprises that make up much of China's GDP has reduced consumer spending power and caused many to postpone their purchases of new phones. As a result, mobile phone sales volume is expected to drop dramatically in the short term: China's mobile phone shipments in the first quarter could decline 30% to 50% from the same period last year.

But sales volume should gradually recover after the pandemic. It helps that the first quarter is usually the low season for mobile phone sales, making it easier to manage lower sales volume. If the coronavirus crisis follows the pattern of the SARS outbreak, pent-up demand should get released after things return to normal. And the outbreak will push Chinese tech players across the mobile phone value chain to accelerate innovation in 5G, artificial intelligence, augmented reality and other areas to generate faster growth. For example, once 5G tech reaches scale, new 5G-enabled phones will stimulate consumers' desire to upgrade their devices.

| Channels

The abrupt COVID-19 outbreak put the brakes on resellers' plans to shrink inventory during the Lunar New Year. Instead, we expect inventory to surge due to the drastic decline in offline sales. Small and medium-sized resellers will have difficulty cutting losses, so they face a dim profitability outlook for the year.

The outbreak also has pushed some Chinese brands to close their offline stores, despite the losses that decision entails. Going forward, these brands are expected to invest more in online channels, which will help accelerate the shift to buying phones online.

The COVID-19 outbreak has reshaped Chinese technology users' behaviors and habits, potentially speeding up a digital transformation already underway. Meanwhile, the digital-enabled battle against the pandemic has shed light on gaps in the organizational capabilities and responsiveness of commercial and governmental bodies to such crises, which will likely solidify their commitment to digital initiatives and result in increased investments to jointly build the connectivity ecosystem.

Tech players can put themselves in the strongest position coming out of the crisis by balancing the orderly resumption of production with strategic actions to respond to the lasting effects of the outbreak. Here are six steps—framed through the lens of the mobile phone industry—that all tech companies in Asia and beyond can take in the coming weeks, months and years to make their businesses more resilient.

| Short-term actions

1.Improve crisis management

Leading firms across the mobile value chain will use lessons from the coronavirus outbreak to quickly strengthen their crisis-response protocols, including crisis prevention, identification, surveillance and response.

2.Adjust business and channel/sales plans

Flexibility will help companies manage the immediate effects of the outbreak on their businesses. The slump in mobile phone sales might require manufacturers to adjust their full-year shipment and sales targets, which will change based on the pandemic situation and market rebound. Timely communication with internal and channel stakeholders can help smooth the transition.

In addition, phone makers can more successfully weather the crisis by standing united with resellers and distributors; this might involve providing proper subsidies, sharing losses and trying to increase efficiency. If done well, they can build closer relationships with partners that will boost the confidence of the post-pandemic market.

Leading firms will also develop sales-stimulation plans for end users before the market rebounds, so they're prepared to serve the first wave of consumers after the pandemic. This might include offering promotional elements such as free gifts and accessories, designing reasonable sales targets and creating rebate-based incentives for resellers to maximize sales and minimize losses caused by the outbreak.

| Medium-term actions

3.Develop a demand-based digital supply chain

The coronavirus outbreak has underscored the complexity of the mobile phone supply chain. Digital technologies such as cloud computing, the Internet of Things and big data analytics can help phone manufacturers and component suppliers better understand and monitor the supply chain. Leading firms will also leverage these tools to develop long-term plans with more precise, dynamic demand forecasting; better identify potential risks; and improve logistics. Not only can they help balance supply and demand, they'll also be more prepared to continue stable operations amid crises such as disease outbreaks.

4.Balance the channel mix

The outbreak has highlighted the importance of online channels and the fact that mobile phone manufacturers have room to expand in this area. Leading firms will invest in e-commerce and logistics systems. They'll work to find the right balance between their online and physical stores to take advantage of their respective strengths, thus increasing sales and profits.

5.Review the global strategy

The crisis will prompt leading phone makers to reassess the importance of each region to the company and the roles of the company in different regions. Leaders will perform a case-by-case analysis to develop the right global strategy for the future.

| Long-term actions

6.Invest to seize new digital opportunities

Xin Cheng

Principal

The authors thank Bain managers Jenny Chen and Stanley Chen and associate consultants Ziyang Wu and Yinan Li for their contributions to this article.

点击查看【贝战疫情,感恩前行】危机中存机遇,科技企业如何致胜长远?原文

微博

微博 微信

微信