Author: Kevin Chang

At a Glance

> In response to the burdens COVID-19 has placed on the healthcare system, the Chinese government will likely accelerate reforms, mirroring the reaction to SARS in 2003.

> To avoid contamination and crowds at hospitals, more consumers are embracing innovative and digital B2C healthcare delivery models—and we expect these behavior changes to stick.

> Faced with major shifts in China's healthcare system, companies can take six steps to navigate the disruption.

For the past two months, the campaign to control, diagnose and treat the novel coronavirus has been a taxing struggle. Stretching China's healthcare system further than the 2003 SARS epidemic, the fast-moving and deadly COVID-19 has resulted in overcrowded hospitals where medical personnel have worked tirelessly to provide care.

Beyond the direct effects of the virus, the epidemic has taken a toll on normal healthcare activities. As other patients avoid highly contagious hospital facilities, and resources are diverted to fight the epidemic, regular medical services have crawled to a standstill. The Chinese Medical Association has delayed all academic meetings scheduled before April. And healthcare companies whose major businesses are not directly related to the epidemic could take a hit in the first quarter.

When the coronavirus outbreak wanes, what will China's healthcare industry look like? While lessons from SARS can provide guidance on how government entities, companies and consumers are likely to react, the implications of the coronavirus are far broader. In a healthcare system already in transition, we expect to see an acceleration in reform, digitalization and patient empowerment.

After the SARS epidemic, the Chinese government quickly launched an overhaul of the healthcare system to improve access to such things as services and high-quality supplies. It invested in systems for disease surveillance and reporting, as well as epidemic prevention and control. Centers for disease control were built across the country. And public insurance programs were vastly expanded to provide affordable care for the rural population.

| Access to quality care

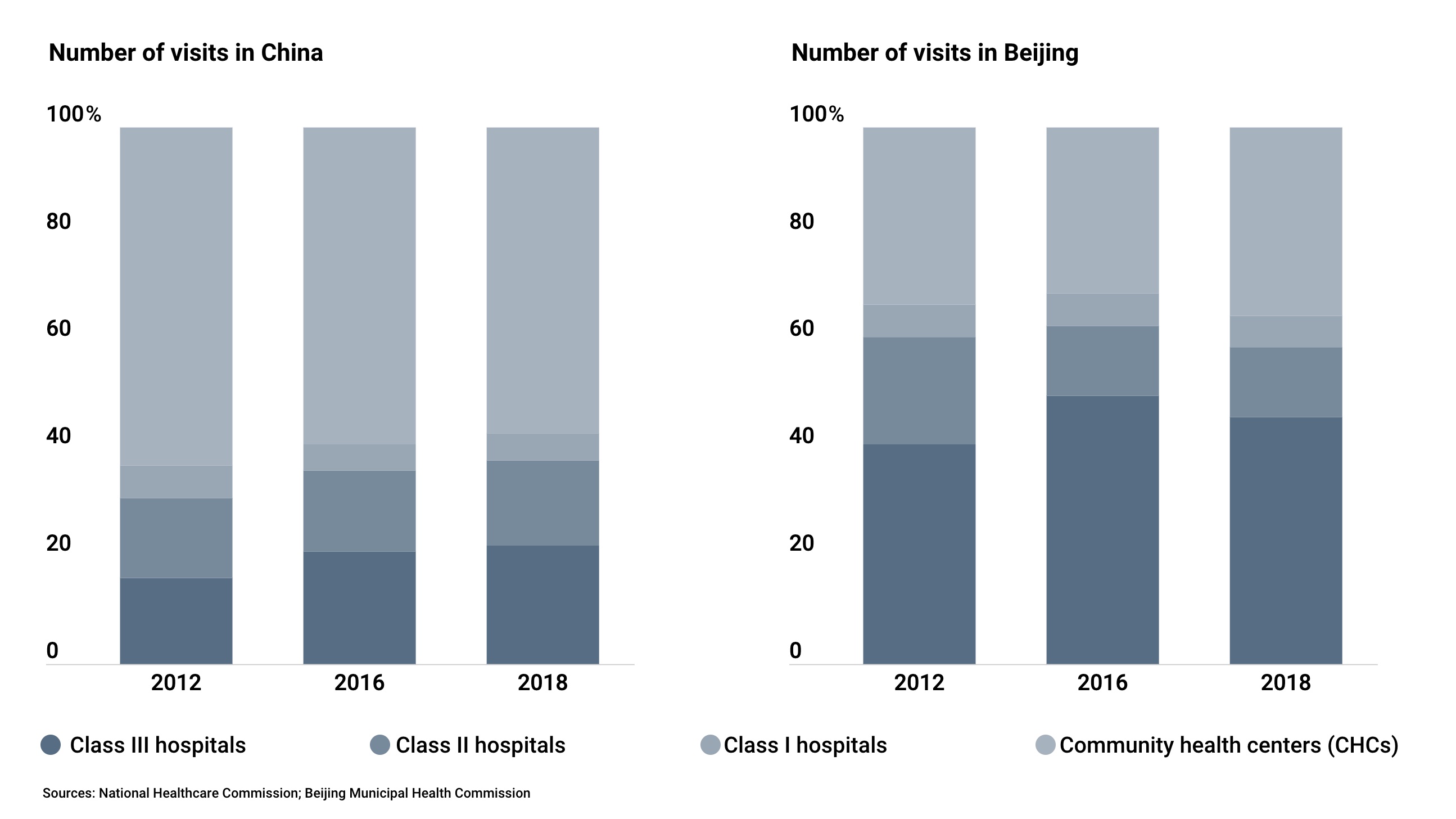

China's tiered healthcare system—in which smaller community health centers (CHCs) and Class I institutions provide first-contact care, and larger Class II and III institutions provide specialist referral services—is designed to distribute patients based on need, freeing up resources at big, congested facilities. But implementation has been arduous. While Beijing and other cities have made some headway with recent decreases in Class III visits, patients still habitually seek treatment from large hospitals (see Figure 1).

In the fight against the coronavirus, CHCs, Class I and Class II hospitals have played an important role in identifying and preventing disease, and isolating patients. Of the 203 CHCs in Wuhan, the epicenter of the virus, 199 were designated for COVID-19 screening and triage. And the first group of patients admitted to Wuhan Jinyintan Hospital included referrals from Class II hospitals. At the same time, with a shortage of public healthcare resources, private facilities and third-party diagnosis and treatment services have provided much-needed relief.

However, only 10 of Wuhan's CHCs were prepared to admit and treat patients with coronavirus symptoms, emphasizing a gap in institutional capabilities. After the epidemic ebbs, the Chinese government will likely double-down on improving the quality and availability of CHCs, particularly in small cities, boosting the efficiency of entire healthcare system. Meanwhile, the high demand for specialization will continue. Hospitals will increasingly outsource to private and third-party institutions that have scale, technology and cost advantages.

| Cost management

China has taken multiple measures to control healthcare costs and cut fees since the SARS epidemic, including centralizing procurement, buying drugs in bulk and implementing a two-invoice policy to eliminate layers of distributors.

| Product innovation

In December 2019, China's amended Drug Administration Law established the market-authorization-holder system, making it easier for pharma companies to bring new drugs to market. Other recent moves, such as fast-track approval for certain medical devices, have likewise paved the way for healthcare innovation. And while cutting the red tape encourages local companies to experiment with alternative medicine, China is also ramping up approvals on foreign drugs.

To find a treatment for COVID-19, Chinese health authorities are working with the US company Gilead Sciences to conduct trials of remdesivir, an antiviral drug, at hospitals in Wuhan. Meanwhile, China's contract research organizations (CROs) have been involved in the R&D of a preventative vaccine. But outside of coronavirus-related developments, pharma and medtech companies, CROs, and contract developing and manufacturing organizations (CDMOs) are grappling with significant delays to normal operations.

| Digitalization

Echoing a global, industrywide sentiment, the Chinese government has called for the integration of big data, artificial intelligence, telemedicine, online pharma retail and more. But healthcare still lags behind other industries in the digital revolution.

The coronavirus epidemic puts a glaring spotlight on the opportunities in digital. While some technologies, such as AI-enabled fever-detection devices, are being rolled out quickly in response to the outbreak, other developments, such as the widespread adoption of electronic medical records, could improve the system's efficiency and transparency in times of crisis.

Beyond systemwide reform, another force is quietly transforming healthcare in China. Although physically locked down in their homes, consumers have become more empowered decision makers. COVID-19 has spurred them to embrace innovative B2C delivery models, reshaping their traditional behavior. Even after government restrictions are lifted and virus fears subside, changes in patient attitudes toward online medical services, retail pharmacies and commercial health insurance will stick.

| Online medical services

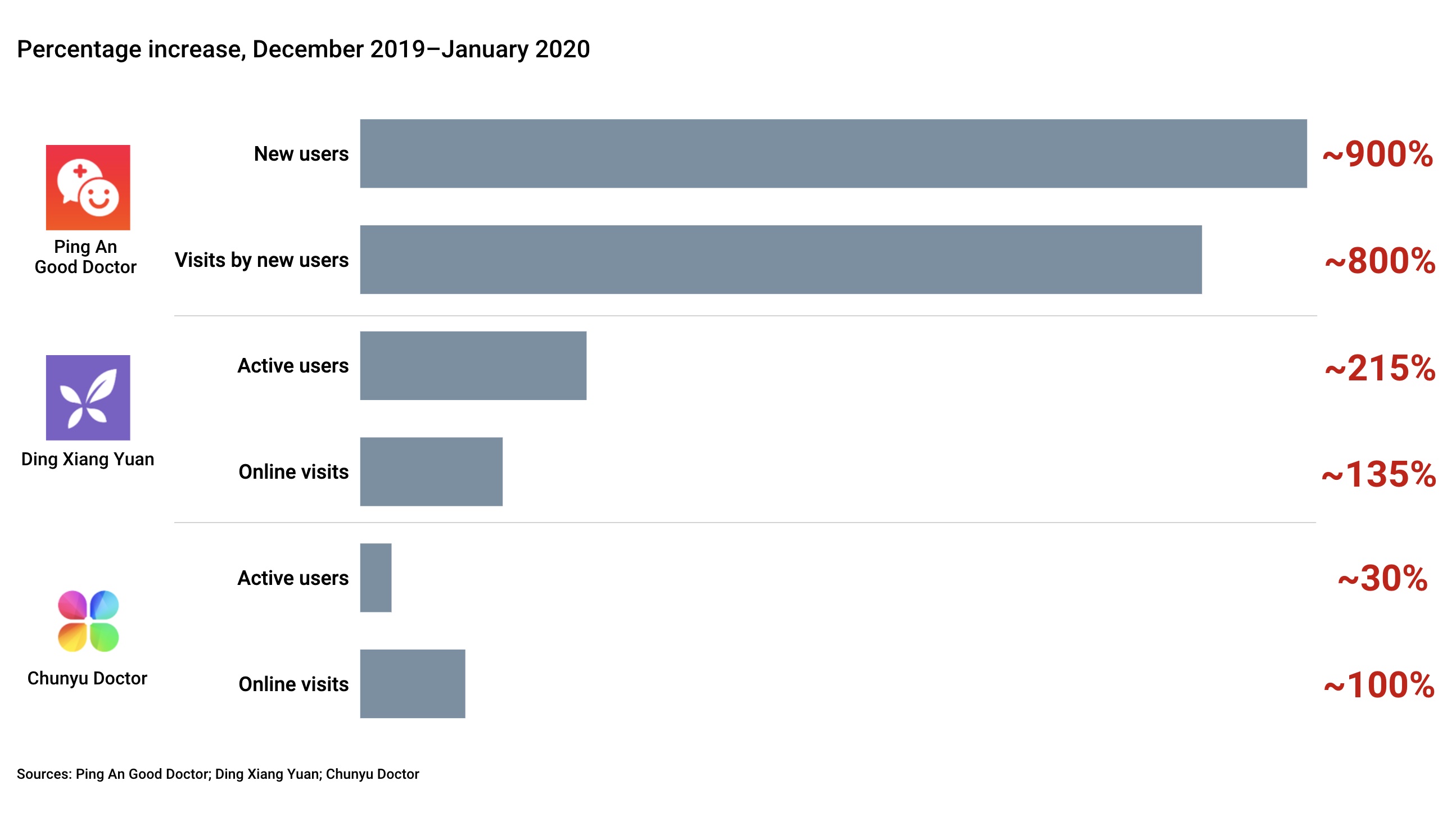

As the number of coronavirus cases climbs, China's online healthcare platforms are growing explosively. Trapped indoors, many patients are turning to Internet-based options for diagnosis and treatment. Ping An Good Doctor, a healthcare services platform, had a nearly 900% increase in new users from December 2019, before the World Health Organization identified the virus, to January 2020, when the virus spread across China (see Figure 2). The number of online users and visits also has surged at Ding Xiang Yuan, an online community for healthcare professionals, and Chunyu Doctor, a telemedicine platform.

Figure 3: Chinese patients expect to use more digital services within the next five years

Figure 3: Chinese patients expect to use more digital services within the next five years

| Retail pharmacies

Attempting to avoid contamination and crowds at hospitals where they traditionally purchase drugs, Chinese consumers initially turned to retail pharmacies for prescription drugs, over-the-counter medicines and face masks. And as the outbreak escalated and lockdowns were enforced, more shoppers have relied on online channels.

| Commercial health insurance

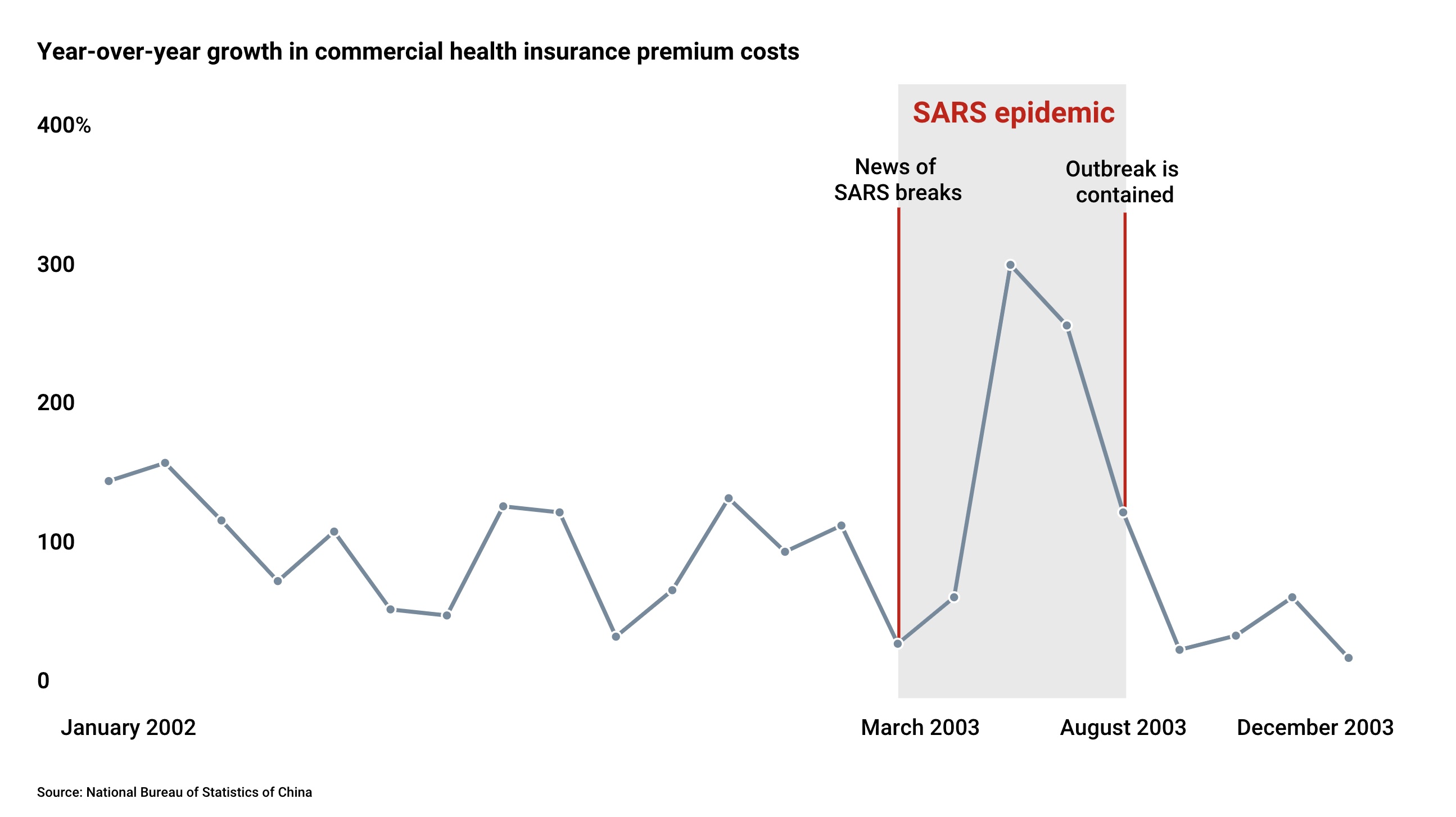

Just 17 years ago, commercial health insurance was an emerging product in China. During the SARS outbreak—when many uninsured citizens had to pay out-of-pocket for medical expenses—commercial health insurance experienced a short-term boom (see Figure 4).

Figure 4: The SARS outbreak fueled a short-lived boom in commercial health insurance

Figure 4: The SARS outbreak fueled a short-lived boom in commercial health insurance

Similar to the SARS epidemic, premium growth rates will return to normal after the coronavirus epidemic. But the public health crisis has put private insurance top-of-mind for many people. While most of the population is now covered by public insurance, the coverage is limited. In response, several insurance companies have added virus coverage to their offerings. Epidemic-related concerns, coupled with the development of private healthcare and a growing range of digital services, will push more Chinese consumers to purchase private insurance. Leading commercial insurers will harness large hospital networks, digital capabilities and a wealth of analytics.

While general trends from the previous epidemic-induced reforms and current consumer behavior can illuminate a path ahead, many things remain uncertain. Local and multinational healthcare companies should size up the situation, act resolutely and be prepared to move quickly as opportunities and challenges present themselves. We recommend six steps as the industry moves forward.

| Immediate actions

> Assess the impact of the epidemic.Adjust annual business targets and budgets according to market conditions and future implications. Be sure to protect key competitive capabilities.

> Join the fight against the epidemic and collaborate with government stakeholders. Offer support to relevant government bodies, medical associations and the greater community through funds, products and research to prevent and control epidemics. Lay the foundation for partnerships to help improve the healthcare system in the long term.

> Be ready for opportunities as well as challenges.Identify the capabilities your business needs in order to become more resilient, and determine how you would acquire them if opportunities arise over the longer term.

| Future actions (one to two years)

> Manage costs for today and tomorrow.Avoid aggressive cost-cutting in response to short-term effects of the epidemic. Instead, cautiously consider the best cost strategies for your business—those that will improve internal efficiency and benefit stakeholders. Invest savings to go deeper and wider in market coverage, developing a model can serve customers across a more robust tiered healthcare system.

> Focus on product, service and business model innovation. Sustain a competitive advantage, make the most of regulatory tailwinds, and navigate economic headwinds through several approaches to innovation, such as organic R&D and product launches, corporate venture capital arms or innovation incubators integration of enhanced digital services to existing products.

> Accelerate digital initiatives. Continuously develop digital capabilities through self-building, partnership or M&A. Use these capabilities to revamp patient and medical personnel experiences, while improving organizational transparency and efficiency. Finally, harness digital records and coordinate with other players to streamline processes across the healthcare system.

点击查看【贝战疫情,感恩前行】疫情之下,中国医疗行业何去何从中文版

微博

微博 微信

微信